Today's story about levels of debt in The Daily Telegraph is grossly misleading and inaccurate.

Here are the facts on debt:

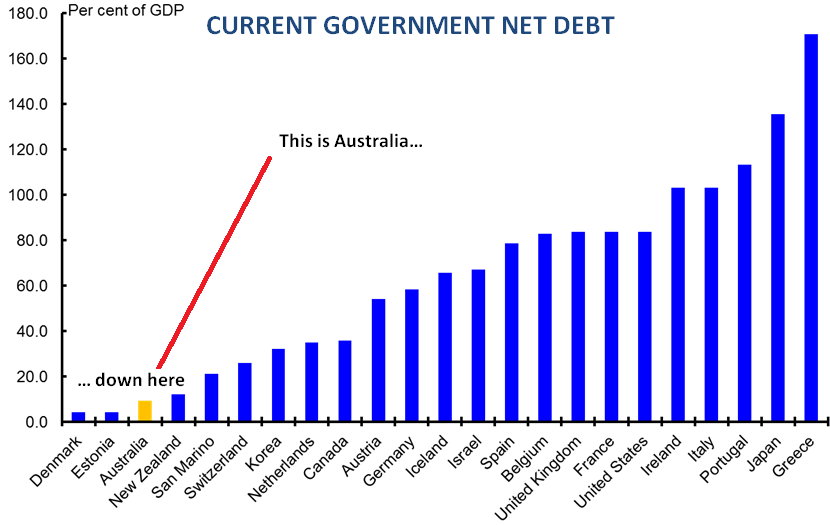

- Australia's net debt is dramatically lower than the net debt levels for every single major advanced economy - our current net debt is 10 per cent of GDP, compared to around 80 per cent for the US and UK and around 35 per cent for Canada.

- Australia was virtually the only developed economy to avoid recession, and since Labor came to office our economy has grown by more than 13 per cent and added more than 900,000 jobs, while tens of millions have been added to jobless queues around the world.

- The impact of the GFC resulted in a $160 billion hit to government revenues - to rip this amount out of the economy in the face of severe global turmoil would have driven our economy into recession and resulted in even higher debt levels.

- The Government is reducing net debt in a sustainable way that ensures our economy remains one of the strongest in the world and protects Australian jobs and economic growth.

This is what Australia's net debt looks like:

This is what ratings agencies, economists and organisations like the IMF have said about our levels of debt:

FITCH REAFFIRMS AUSTRALIA'S AAA RATING - 26 October 2012:

"The 'AAA' ratings reflect Australia's fundamental credit strengths including the country's high-income developed economy, credible macroeconomic policy framework with scope for policy flexibility, and standards of governance that rank among the world's strongest."

Australia's ratings also benefit from low gross and net general government debt ratios relative to 'AAA' peers.

S&P REAFFIRMS AUSTRALIA'S AAA RATING - 20 December 2012:

Further, public sector debt in Australia remains low.

We affirmed the 'AAA' ratings on Australia with a stable outlook on Sept. 18, 2012. The stable outlook reflects our view that Australia's public finances will continue to withstand potential adverse financial and economic shocks, and our belief that the country's consensus in favor of prudent budgetary policies will remain.

Blackrock Report on Sovereign Risk - January 2013:

Sound public debt metrics continue to underpin Australia's desirability as an investment location.They also indicate that Australia is well-placed to avoid the difficulties faced by other developed nations which are now seeking to bring their medium-term public finance settings back to sustainable footing.

HSBC's Paul Bloxham- 20 December 2012 - Sky News:

We've got very low levels of government debt,our economy is performing well and if you're comparing us to the rest of the developed world we're in pretty good shape.

OECD Economic Survey of Australia- 14 December 2012:

With 21 years of uninterrupted growth Australia stands out among OECD countries. This performance has been sustained by sound policies and, more recently, booming demand for commodities from Asia.

Australia's public finances are in much better shape than those of many OECD countries.

IMF Article IV, 16 November 2012:

'The authorities' adept handling of the fallout from the GFC, their prudent economic management, and strong supervision of the financial sector, has kept Australia on the dwindling list of AAA rated countries.'

[IMF] 'Executive Directors commended the Australian authorities for their sound and prudent macroeconomic management, which had contributed to impressive growth, low unemployment, and subdued inflation.'

'Five years on, both the economy and the financial sector continue to outperform most of their peers'.

The labour market remains flexible, and unemployment is a relatively low 5 per cent. Modest inflation allows the Reserve Bank of Australia flexibility to adjust interest rates. Reforms are reducing the range of goods that are subject to price controls.