I acknowledge the traditional owners of the land on which we meet, the Gadigal people of the Eora Nation.

I pay my respects to Elders past and present and to any First Nations people with us today.

I’m really thrilled to be here. I’ve been the Housing & Homelessness Minister for exactly 6 weeks.

And one of the real delights in the portfolio so far is spending lots of time with the builders and tradies who are going to build the houses we need to get us out of the crisis we’re in.

Your industry is all about taking action. About getting moving and solving problems.

I love the can‑do culture.

And we are going to need to tap into that.

Because you are working right in the guts of one of the most critical social and economic challenges in Australia today.

We’ve got a mainly business crowd here today.

I grew up in a very entrepreneurial household – my parents each owned their own small business.

But I was also raised to believe that if you wanted to change your country for the better, politics was the place to go.

I have 3 young children. And I am acutely conscious when I go to work every day that my job in politics is to make our nation better for them.

I take my work extremely seriously. I like to do hard things.

And so, in politics, I always want to go where there is the most challenge.

I do not think there is a better place in government or public policy today, than working in Housing and Homelessness.

I take on these portfolios at a pivotal moment.

We do not have enough homes in our country, a problem that has been cooking for more than a generation.

The homes that we do have aren’t affordable.

And we have huge challenges in construction – deep and difficult problems in skills, in financing, in planning, and materials, which have slowed housing builds at a time when we most need them to grow.

These are the practical problems.

But of course, housing is not just about practicalities.

Housing is the foundation for the life experience of every person in our country.

I do not think – other than your health – that there is a more concrete determinant of your quality of life than the housing you live in.

Housing defines almost everything.

This is about how and where you live, the economic opportunities you can access, how and where you have to travel each day, your ability to set down roots, to start a family.

Housing hits at the heart of the expectations young Australians have about their future.

In large part, it defines how wealth is distributed in our country, between the generations, and between those who inherit housing wealth and those who will not.

And it is about who we are as Australians.

About what life experience our citizens are entitled to, and what governments are willing to do to make it happen.

Today I want to do 3 things.

I want to explain in the clearest language possible why we have a housing crisis.

I want to tell you what our government is doing about it.

And I want to talk about you about how we want and need you to work with us to solve this great national challenge.

Now, some of you may know that I have an incredibly nerdish love for graphs and data. One of the many reasons I am such a huge hit at dinner parties.

I am going to share a small handful of charts which show you what has happened to housing in our country, and why we are where we are.

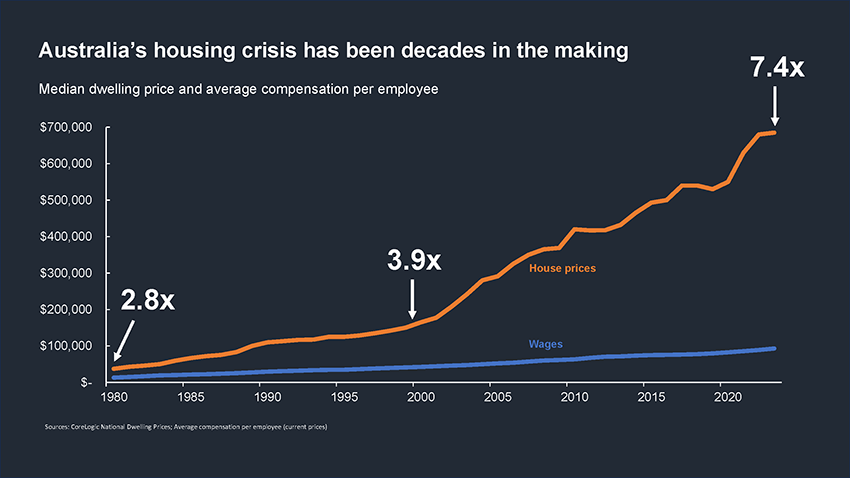

Sources: CoreLogic National Dwelling Prices; Average compensation per employee (current prices)

Australia is in the middle of a housing crisis which has been decades in the making.

This chart shows us that incomes and house prices were diverging in the 1980s, and that this problem accelerated acutely from the late 1990s.

At the turn of the century, the median household price was about 4 times average incomes. Today it is nearly 8 times.

Why have prices gone up in this way?

Because for a long, long time in our country, we have not been building enough homes.

Put simply, in Australia today, we do not have as much housing per person as countries we would compare ourselves to.

Australia has among the least housing per person than comparable countries and is far below the OECD average.

Less than France, less than the UK, less than Canada.

Fewer homes means less affordable housing.

Because the same number of buyers and renters are spread across fewer homes.

It sounds trite – but what happens when we build more homes?

Housing becomes more affordable.

This is not just the law of supply and demand.

It is what the experts tell us, and it’s what happens in practice too.

Where we’ve seen upzoning and more houses built in cities around the world, rents have fallen.

How do we see this shortage of housing in Australia manifesting in the lives of our citizens?

We see it in the rental market, where young people – and many not so young – line up in a queues of 50 people to inspect a rental property that shouldn’t even be on the market.

It is experience of renting, where rents are rising too fast, and too often.

We see it in home ownership, where most of Australia’s young people feel they will never have the housing opportunities enjoyed by their parents.

And, we see it in that deeply distressing number of people who are falling out the bottom of the market altogether – in rising homelessness around our country.

One of the most worrying consequences of this is how out of reach home ownership has become for specific groups of Australians.

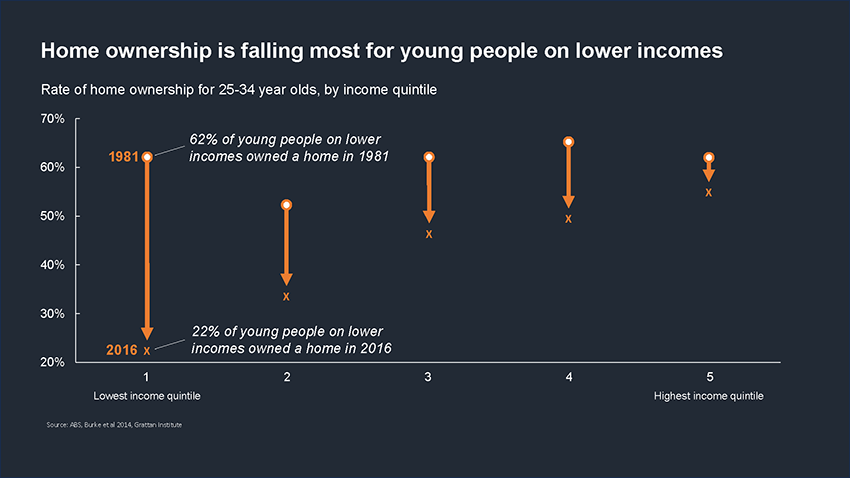

Source: ABS, Burke et al 2014, Grattan Institute

Home ownership rates have fallen for all age groups and income groups over the last 40 years, but the really massive shift is home ownership rates for young people on lower incomes.

In 1981, more than 60 per cent of lower income young people owned their own home.

Now this is nearing 20 per cent.

This is a dramatic change to the entire life experience of this cohort of people. To their stability, their ability to set down roots, to start a family, to accumulate wealth.

And that this has occurred over just a 40‑year period.

This chart tells us that to be low income today means something very different today than it did 40 years ago.

If our problem is our failure to build enough homes, the answer to Australia’s housing crisis is at once simple and complex: to solve Australia’s housing crisis, we need to build more homes, more quickly.

And yet, at this very moment, our construction industry faces some very, very big problems.

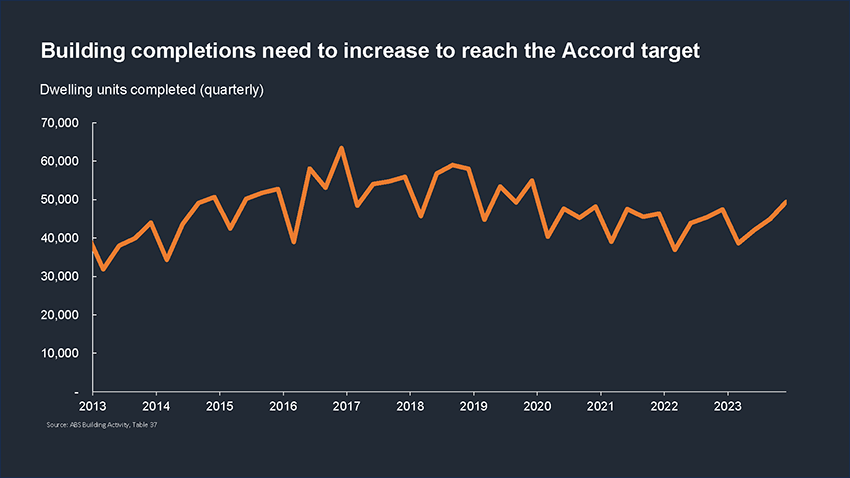

Source: ABS Building Activity, Table 37

Our government came to office at a significant downturn in residential construction. In fact, the quarter before we came into office, new builds were at their lowest level in nearly a decade.

Since taking on this portfolio, I’ve spent a lot of time on building sites, and sitting down with industry to understand what’s going on. And I want to tell you what I’ve heard. It’s a story of 5 big challenges.

First, we face a chronic shortage of construction workers.

We need 90,000 more workers in the residential construction sector to get the houses built that we need.

When we came to office, we arrived to find a profoundly broken migration system, a skills system with chronic underinvestment, and in the middle of the worst skills shortage in more than 50 years.

We’re in the middle of a heap of work to turn this around – and I’ll dive into a bit of detail on this one in a moment.

Second, we have a construction productivity problem.

Construction productivity has been stagnant since the 2000s. For most residential construction, experts tell me that we are building houses in much the same way as we were thirty years ago.

And we can add to the list the very sharp increase in construction costs. Between 2020 and 2023, construction input costs – things like wood, cement, steel frames – experienced their sharpest rise ever.

Part of the answer here is to work together to find innovative ways to bring down lead times, and material costs.

Third, we have a finance problem.

As with the rest of the world, we’ve experienced the fastest hike in interest rates in decades.

And right now, when we have chronic needs for further housing, developments which might have been economic 5 years ago today can’t get off the ground.

Fourth, how we use our land.

In Australia, our planning system is too slow, and we don’t have enough areas zoned for medium and high‑density development.

I do have faith that this culture is changing – the YIMBYs are overtaking the NIMBYs. But it remains an issue.

And finally, we’ve had a deficit of government leadership and investment.

For a long time, Commonwealth governments have tapped out of housing as an issue. Indeed, for most of decade the previous government were in power, they did not even have a Commonwealth Housing Minister.

And this is really one that is changing.

Our government is back in housing in a big way.

We are back leading the conversation, and we are rolling up our sleeves, getting into this with the states, and with the people in this room.

Our country faces a housing crisis, and you in this room are facing some deep and systemic problems in construction. So, what is our government doing about these problems?

I mentioned that we arrived in office to find that the Commonwealth had effectively tapped out of housing.

Today our country is led by a Prime Minister who grew up with a single mum with a disability. His entire life trajectory was reshaped by the access to secure housing he had in his childhood.

It’s no wonder we have a bold and ambitious agenda to tackle this challenge.

This agenda has 3 big planks.

First, we are pushing our country to build, build, build. We need more homes, more quickly.

Because we know that this is the best and most lasting fix.

We have set an ambitious plan – in partnership with the states and territories – to build 1.2 million homes over the next 5 years.

We know this will be a challenge. But we are not going to fix a crisis this size without some boldness, and ambition.

Just last month, I met with state and territory housing ministers, and I’ve met frequently with builders around the country to talk to them about how we can push for this target. Just last week, I had a big session on this subject with the largest residential builders in the country.

They’re all up for the challenge.

Our focus is on unlocking the housing system so we can build more homes.

What the Commonwealth needs to do – and what I will do as Minister – is work with you to try to grow the capacity of housing construction in our country.

Interest rates have risen sharply and this has a big impact on building starts.

Our goal is to lift the fundamental capacity of the sector. So that when interest rates turn, Australia can build more homes than our country has built before, and keep that number high.

This is an unusual policy problem for a federal minister to confront. It won’t be solved by making speeches in Parliament House in Canberra. The solution sits in the real economy.

It is a gritty, grinding task that will see me as minister rolling up my sleeves, working with my colleagues, and with builders around the country.

And indeed, this work has already started to occur.

Part of our policy is to provide national leadership and funding to state governments to get homes built quickly.

We’re training more tradies, funding more apprenticeships and growing the workforce.

And our government is funding the biggest investment in social housing in more than a decade.

The big long‑term answer to this problem is to build more homes.

But we also know that Australians are doing it tough right now – and that’s why as well as our focus on building, the second part of our approach is to provide new support to renters.

Renters are really copping it at the moment. They’re facing increasing rents, massive competition for rental properties, and a sense of real despair that they’ll never get into home ownership.

That’s why our government has delivered back‑to‑back increases to Commonwealth Rent Assistance – this means $1000 more a year for more than 1 million households.

Renters rights sit constitutionally with the states. But we’ve pulled the states together and asked them to agree to a set of new rules, called ‘A Better Deal for Renters’. It’s an agreement which is seeing each state and territory change their laws to ensure things like no‑fault evictions are outlawed.

We want more renters to have the chance to own their own home. Having working‑ and middle‑class Australians realise their dream of home ownership is core business for Labor – and it always will be.

That’s why the third part of our approach is to help more Australians buy – especially assisting first homeowners to get into the housing market.

And we’re seeing some traction here. A third of first home buyers are now being helped into the market through the government’s Home Guarantee Scheme.

This is our approach – helping Australians build, rent and buy.

I want to close with sharing where we are going next.

We need to do more to turbocharge the delivery of 1.2 million homes.

I was in Western Australia last week and I heard loud and clear from builders that their biggest constraints to building more houses is a lack of skilled workers.

I want to acknowledge the work of the former Minister for Skills and Training Brendan O’Connor, as well as the new Minister for Skills and Training Andrew Giles who are carrying on the vital work of skilling our economy.

We need 90,000 people more workers in the construction sector than currently exists. Our focus is on training Australians for these jobs and that’s the work that’s underway.

Our government’s goal is to elevate vocational education and training to the same status as university.

More than 500,000 Australians have enrolled in a Fee‑Free TAFE course since we launched it in 2023, including more than 21,000 in construction related courses.

And we have recently funded an additional $90 million skills package to support 20,000 more people into vocational training for jobs in the housing and construction sector.

We’ve got real issues in our apprenticeship system – about half of all apprentices don’t finish their training.

Earlier this year, our government announced a Strategic Review of the Australian Apprenticeships Incentive System to be led by the Honourable Justice Iain Ross AO and Ms Lisa Paul AO.

The Coalition left a funding cliff in their final Budget, cutting support for apprentices and their employers to below pre‑pandemic levels.

Not the best move in a skills crisis.

We’re taking a different approach, working with industry and experts to develop a sustainable and effective, long‑term support system.

We’ve invested an additional $265 million to increase financial support and provide stability to apprentices and employers while we await the Review recommendations.

Builders share the view that while their priority will always be to train Australians to fill jobs, but there is always going to be a place for skilled migration...

Especially in overcoming our short‑term skilled labour needs.

Migration is something we are keen to work with you on. We have a migration system which is hard for people with policy PhDs to understand. So a subcontractor working on a new residential build has got Buckley’s Chance of being able to utilise the system.

We’ve made changes which have already seen some better flow of construction workers through this system.

10,000 skilled construction workers were granted visas last year.

This is the highest in nearly a decade.

But even our biggest building companies are generally not using the migration system – this is something that needs to change if we’re going to build more homes and something we’re focused on – alongside those big training investments.

We also need to do more to expand rental stock and help renters move into owning their own home.

And we have 2 pieces to the puzzle before the Senate right now.

One would drive investment in Build to Rent developments.

This bill would deliver tens of thousands of additional rental homes, many of those affordable, and more secure tenancies for the renters that live there.

The experts agree it’s a good move.

So too does the crossbench.

But the Liberals and the Greens have built a terribly destructive anti‑housing alliance in this term of Parliament. Just about everything our government has tried to pass has been blocked in the Senate.

It’s incredibly disappointing, and we are going to need to see people set aside their political interests if we’re going to make progress here.

The other is Help to Buy.

40,000 Australians – nurses, childcare workers, teachers – would all be able to buy a home through this program.

The very Australians that I said were losing out on the dream of home ownership.

If we are going to get action on this problem, we need some good will in the Parliament.

And we need strong and real partnerships with the people in this room.

We face real political challenges in addressing the housing crisis.

But it won’t stop us from working with you to build, build, build.

Because we know that housing will only become more affordable when we can build more of it.

Whether you’re renting, buying or building, more homes will mean more security for everyone.

I’m 6 weeks in, but I’m really looking forward to the discussion today, and working with you on this urgent national problem.

Thanks for having me today.

Text descriptions

Text description of Figure 1

Line graph comparing median dwelling prices to average wages in Australia, 1980–2020. Shows growing disparity between housing costs and incomes:

- 1980: house price to wage ratio 2.8x

- 2000: ratio 3.9x

- 2020: ratio 7.4x

Graph demonstrates sharp increase in house prices outpacing wage growth over 4 decades.

Text description of Figure 2

Bar graph showing decline in home ownership for 25–34 year olds across income quintiles, 1981 vs 2016:

- Lowest income quintile: 62% (1981) to 22% (2016)

- Decline visible but less severe in higher quintiles illustrates disproportionate impact on lower‑income young adults.

Text description of Figure 3

Line graph of quarterly dwelling unit completions in Australia, 2013–2023:

- Y‑axis: 0–70,000 units

- Shows fluctuations over time

- No clear upward trend in recent data. Suggests current completion rates may not meet National Housing Accord targets.

Text description of Figure 4

Our Homes for Australia plan — helping you build, rent, buy

What we're doing and how we're doing it, under the 3 areas of Build, Rent and Buy.

Build

Building 1.2 million new homes over the next 5 years

- Training more tradies, funding more apprenticeships, growing the workforce

- Kickstarting construction by cutting red tape

- Paying state governments to get homes built quickly

- Providing tens of thousands of new rental homes through Build to Rent

Delivering the biggest investment in social housing in more than a decade

- 40,000 new social and affordable homes

- More housing for women and children fleeing domestic violence

Rent

Providing relief to renters and strengthening their rights

- Delivering the biggest increase to rent assistance in more than 30 years

- Strengthening renters' rights through A Better Deal for Renters

Buy

Supporting first home buyers to get into the housing market

- Getting one-third of first home buyers into the market through an expanded Home Guarantee Scheme

- Helping 40,000 low and middle-income Australians buy their first home through Help to Buy