Introduction

Today we are releasing the fifth Intergenerational Report.

A document that comes out every five years and projects 40 years forward.

It’s not a guarantee of what will be, but an insight into what could be.

It highlights key economic and demographic trends.

The age and size of our population.

The long term impact on the Budget of existing revenue and expenditure settings.

And coming in the wake of Australia’s COVID‑19 recession, our first in nearly 30 years, it foreshadows the longer term consequences the pandemic will have on our economy.

In this sense the IGR informs and educates, providing a guide for future policy decisions.

There are three key insights from this year’s IGR.

First, our population is growing slower and ageing faster than expected.

This impacts economic growth and workforce participation.

Second, the Australian economy will continue to grow, but slower than previously thought. Growth will continue to be highly dependent on productivity gains.

Third, while Australia's debt is sustainable and low by international standards, the ageing of our population will put significant pressures on both revenue and expenditure.

Before discussing the details of this year’s IGR I want to look at how the economy got to where it is today including the fact we entered the COVID‑19 pandemic from a position of economic and fiscal strength.

Where we’ve come from

A lot can happen in 40 years and a lot has happened in the past 40 years.

Australia in 1981 had a population of 15 million.

An economy just a third the size it is today.

Since then, we’ve navigated recessions, natural disasters and technological disruption.

We have reformed and opened up our economy to the world.

And we have seen the centre of global economic activity shift to our region.

And through this period of significant change our economy has come out on top.

One reason for our success is that we identify and prepare for the challenges that we face.

In 1996, Peter Costello introduced the Charter of Budget Honesty.

He rightly hailed it a ‘major structural reform of the way in which this country presents and runs its fiscal policy.’

The Charter sets out the principles that underpin sound fiscal management.

Managing financial risks and maintaining debt at prudent levels.

Keeping the burden of taxes reasonably stable and predictable.

Having regard to the financial effects of current policies on future generations.

These principles have never been more important.

They continue to underpin the Government’s fiscal strategy and guide our economic plan.

The Charter requires the Government to prepare an Intergenerational Report.

The report assesses the long‑term fiscal sustainability of current policies and highlights how structural changes in our economy, population and environment could affect the budget.

The IGR provides a modelled view of the future over the next 40 years.

All projections are inherently uncertain, particularly over such long timeframes.

Events will occur that can’t be anticipated and government policies will change over time.

Including in response to the challenges identified in IGRs.

Each IGR has informed the way governments have thought about policy issues and framed their budgets.

For example the 2002 highlighted an ageing population.

Peter Costello responded to this challenge by establishing the Future Fund now $178 billion strong and a vitally important reform.

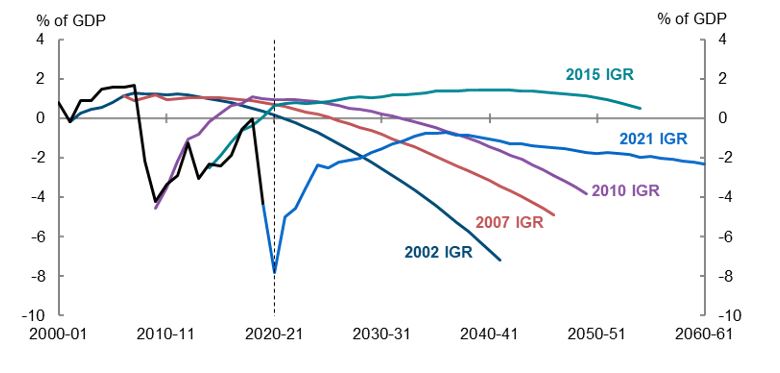

A common feature of all IGR’s is that they have projected budgets that initially improved before being weighed down by the impacts of an ageing population.

However, each IGR has taken a more optimistic view than the one that preceded it.

This is partly because successive governments have acted to respond to the challenges identified.

The IGR does not give us a fixed picture of our fate.

Instead it provides us with guard rails to help guide future government decisions.

To set us up for tomorrow, even as we tackle the challenges of today.

Where we are

COVID‑19 has generated the most severe global economic shock since the Great Depression demonstrating the value of being prepared.

Australia entered the COVID‑19 pandemic from a position of economic and fiscal strength.

A balanced budget.

Workforce participation at a record high.

Welfare dependency the lowest in a generation.

A strong fiscal position allowed the Government to respond decisively to the once‑in‑a‑century pandemic with $291 billion in direct economic support.

The speed of our economic recovery has exceeded all expectations.

Australia’s economy outperformed every major advanced economy in 2020.

Unemployment has fallen for seven consecutive months, dropping to 5.1 per cent.

This is the same level as it was in February last year.

And Australia remains one of just nine countries around the world to hold a AAA credit rating from the three major rating agencies.

Indeed, earlier this month, Standard and Poor’s upgraded Australia’s AAA credit outlook to stable.

This is recognition that our economic recovery plan is working.

But we still face significant challenges.

COVID‑19 has not been defeated. As the current outbreaks in New South Wales and other jurisdictions attest.

This is a difficult time but Australians have been magnificent in responding to this crisis.

We are better placed than almost any other country to meet the economic and health challenges that lie ahead.

Where we are going

Now, I’d like to turn to this IGR. To Australia’s future.

How our economic and fiscal outlook might evolve over the coming 40 years.

The economy over the next 40 years

The IGR has long relied on the 3P’s framework to assess our future trends.

Together, population, participation and productivity play a major role in our future prosperity.

COVID‑19 hasn’t displaced the long‑term structural trends that were already present pre‑crisis.

Slower population growth and demographic ageing, which reduces participation, mean the economy is projected to grow at a slightly slower pace over the next 40 years than we have been accustomed to.

Real GDP is projected to grow at 2.6 per cent per year over the next 40 years.

This compares to 3 per cent over the past 40 years.

Real GDP per person is projected to grow at an average annual rate of 1.5 per cent, only slightly below the 1.6 per cent average over the past 40 years.

Population

The most enduring economic effect of COVID‑19 is likely to be a smaller overall population.

This reflects sharply lower migration during the pandemic.

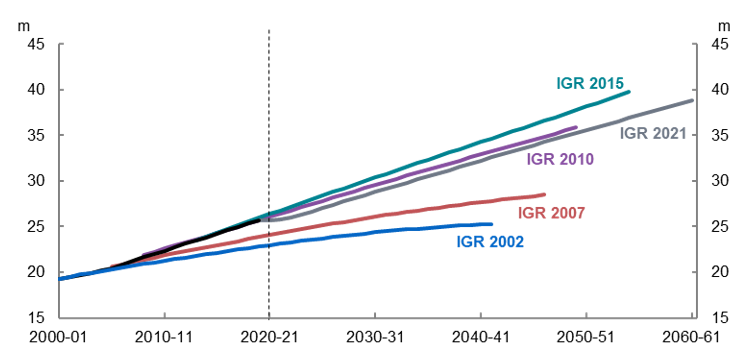

The 2015 IGR projected that Australia’s population would reach almost 40 million by 2054‑55.

This IGR projects the population will reach 38.8 million in 2060‑61.

This is the first time there has been a downward revision to the long‑term population projections in an intergenerational report.

Population projections

This means the economy will be smaller and Australia’s population will be older than it otherwise would have been, with flow‑on implications for our economic and fiscal outcomes.

This makes it more important than ever to make careful and informed choices about our migration settings as international borders reopen.

With fertility rates falling, migrants will continue to be our largest source of population growth.

Net overseas migration accounted for around 60 per cent of growth over the past decade.

The IGR projects this will increase to around 74 per cent by 2060‑61.

This is based on an assumption that net overseas migration remains fixed at 235,000 people per year, even as the total population grows.

So the composition of the Migration Program needs to be right.

A well‑targeted, skills‑focussed Migration program can supplement our stock of working age people, slow the transition to an older population and improve Australia’s economic and fiscal outcomes.

Ageing

The other key population challenge highlighted in this IGR is the continued demographic ageing of the population.

In 2060‑61, 23 per cent of the population is projected to be over 65, a rise of around 7 percentage points from 2020.

Right now we already are in the middle of the biggest demographic transition of the last century.

Many baby boomers are reaching retirement right now.

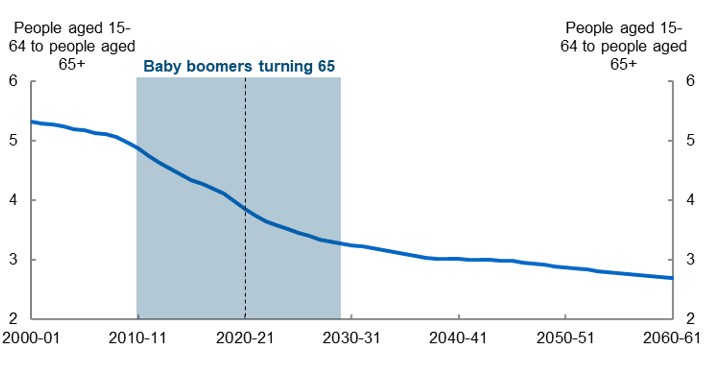

This is contributing to a rapid change in the ratio of working‑age people to those over 65.

In 1981‑82, for each person aged over 65, there were 6.6 people of working age.

Today, there are 4 to 1.

By 2060‑61, it will only be 2.7 to 1.

The fact we are living longer is to be welcomed.

But the impacts on the economy and the budget are profound.

The dramatic increase in health and aged care spending together with the decline in the proportion of working aged Australians creates pressures on both revenue and expenditure.

It is a warning sign and underlines why growing the economy is so important.

Only by growing the economy can we continue to guarantee the essential services Australians rely on.

Old‑age dependency ratio

Participation

If I now turn to participation, this has been a positive story as we have moved from IGR to IGR.

Currently, around 66 per cent of the working‑age population participate in the labour force. A record level.

This is around a percentage point higher than projected in the 2015 IGR.

If the 2015 IGR participation projection was applied to today’s population, there would be 230,000 fewer people participating in the labour force today.

This would be like taking the whole population of Hobart out of the labour force.

Increased participation by women has been the largest factor.

Increasing by 18 percentage points since the 1970s.

A stronger retirement income system, increased life expectancy and the greater availability of part‑time and less physically demanding jobs have all contributed to higher levels of participation.

In turn, this has made our economy more productive and our budget stronger.

As the population ages however, a smaller overall proportion of Australians will participate in the workforce. Even as people participate more at each stage of their life.

This is expected to see the participation rate decline to 63.6 per cent by 2060‑61.

This is a structural change which can only be partially offset by higher participation rates of women and older Australians.

But we can, and should, continue to support higher participation across the economy.

The $1.7 billion investment in our recent Budget to make childcare more affordable is an important example of the ways in which the Morrison Government is doing this.

Productivity

With lower population growth and falling participation, economic growth will continue to be highly dependent on productivity gains.

In many ways, productivity is the most vital ingredient in lifting our long‑term living standards and wages.

Productivity as Nobel prize winning economist Paul Krugman has said ‘isn’t everything, but in the long run its almost everything’.

The economic projections in the IGR assume that labour productivity will converge to 1.5 per cent per year — consistent with the 30‑year historical average to 2018‑19.

This, however, will require an improvement in Australia’s recent productivity performance of 1.2 per cent over the most recent cycle.

Australia’s recent performance is consistent with broader global trends.

Across much of the developed world, we have seen a well‑documented slowdown in productivity growth since around 2005.

The Productivity Commission recently noted that “Australia’s slowdown in productivity is actually less pronounced than that experienced in most other advanced economies”.

Indeed the PC said of Australia’s productivity slowdown that “it is unlikely that domestic policy factors play a strong role given how widespread the slowdown is globally”.

But with productivity responsible for over 80 per cent of Australia's national income growth over the past 30 years, the task is obvious and the choice is clear.

If we want to maintain our living standards, generate higher wages and create more jobs, Australia has no alternative other than to pursue economic reform, much of which is hard and contested.

It is a national imperative.

But, the recipe for reforms is unlikely to be the same as in the past.

There is no silver bullet.

The story of the earlier productivity boom is well‑known.

In part, it was driven by big bang reforms.

Floating the dollar, reducing tariffs, competition policy, taxation reform and deregulating the financial system.

But you can’t float the dollar twice.

Those big bang reforms are once offs – they cannot be repeated.

Increasingly, reform is likely to be more incremental.

Taking each and every opportunity to boost productivity, no matter how big or small.

That’s my focus.

That is why we took the opportunity presented by COVID to reform the insolvency system with the biggest changes in 30 years.

That is why we tackled the emerging issue of digital platforms, to promote competition with changes that have led the world.

That is why we have pushed ahead with important reforms to the superannuation system the most significant since compulsory began in 1992.

That is why we have legislated the abolition of an entire tax bracket creating a fairer and stronger tax system as part of a plan to deliver more than $300 billion in personal income tax relief.

That is why we have been working with the states to reduce red tape and create a uniform scheme for automatic mutual recognition of occupational licences, a reform that has been in the too hard basket for more than a decade.

That is why we announced a new ‘patent box’ to encourage the commercialisation of innovation in Australia and complement the $2 billion R&D Tax Incentive.

It is also why we have established a Consumer Data Right to give consumers more control of their personal data and boost competition.

Reform is about taking every practical opportunity to make life easier for businesses, improve the efficiency of government services and boost competition and innovation across our economy.

That is our challenge.

But there are also reasons for optimism.

COVID‑19 has significantly accelerated the pace of technology adoption, business digitalisation, and is changing the way we work, communicate and shop.

This has the potential to spur a new wave of innovation and productivity growth.

And we are positioning Australians to make the most of these opportunities of the future, including by investing more in skills, new energy technology, digital technology and R&D.

These reforms and investments will boost productivity and set Australia up for the future.

Environment

The changing climate will also affect the economy and the budget.

The physical and transitional effects of climate change, the impacts of mitigation efforts and the benefits of early adaptation measures will all affect the economy and the budget over time.

The transition to lower carbon emissions globally will mean that some sectors will need to adjust to falling demand for some exports, while new opportunities will be created in other sectors.

The effects will depend on domestic and global actions, as well as the pace and extent of climate change.

Australia is playing its part on climate change, having met our 2020 commitments and being on track to meet and beat our 2030 target.

As I said on Budget night, Australia is on the pathway to net zero and our goal is to get there as soon as we possibly can, preferably by 2050.

To get there, we will use technology that enables and transforms industries, not taxes that penalises them and the jobs and livelihoods they support.

The budget over the next 40 years

Finally, I would now like to turn to the fiscal projections contained in the IGR.

COVID‑19 has changed many things, but one thing has not changed.

That is the critical importance of sound budget management and fiscal sustainability.

Managing the budget so we can continue to guarantee the essentials Australians rely on, both now and into the future.

The IGR confirms that the Government’s fiscal position is sound and sustainable.

Even allowing for the demographic headwinds, our debt levels remain low by international standards and relatively stable over the projection period.

But of course, there are long‑term fiscal challenges to be addressed.

Initially, the underlying cash balance is projected to improve to a deficit of 0.7 per cent in 2036‑37, supported by our strong economic recovery.

Assuming no policy changes, the deficit is then projected to widen to 2.3 per cent by 2060‑61 as the effects of ageing take hold.

While this is a sobering projection, it is significantly smaller than the fiscal gaps projected in most past IGRs.

The Howard Government’s 2002 and 2007 IGRs forecast deficits at the end of the 40 year period of 7 per cent and 5 per cent respectively and the Rudd Government's 2010 IGR forecast a deficit of 4 per cent in 2050.

Only in 2015 was a surplus forecast of 0.5 per cent at the end of the period, but that was in the absence of COVID, the biggest economic shock since the Great Depression.

Underlying cash balance across intergenerational reports

As outlined in our fiscal strategy, our immediate priority is to support our economic recovery and drive unemployment lower.

The extraordinary fiscal support measures we have deployed to tackle COVID‑19 were necessary, but they were also designed to be temporary.

But once our economic recovery is secure, we have a responsibility to do the work necessary to restore our finances and re‑build our fiscal buffers.

This is a challenge we have tackled before.

When we came to Government in 2013, the budget was a deficit of 3 per cent of GDP.

In 2018‑19, we brought the budget back to balance for the first time in 11 years.

As we did before COVID‑19 struck, we will keep the budget in order by getting more Australians in jobs with a stronger economy and with fiscal discipline, not with austerity.

The increasing fiscal gap projected in this year’s IGR reflects growth in spending while taxes remain capped as a share of the economy.

In particular, health and aged care spending are projected to grow significantly.

Health spending is projected to grow from 4.1 to 6.2 per cent of GDP by 2060‑61.

At the same time, spending on aged care and the NDIS is projected to grow significantly.

We are committed to funding these essential services while maintaining a sustainable tax burden.

Taxes are capped at 23.9 per cent of GDP.

It is a responsible approach which seeks to maintain fiscal discipline.

Some might suggest an easy way to paint a more optimistic picture of the budget position would be to remove the tax‑to‑GDP cap.

But as we know you can’t tax your way to prosperity.

By keeping taxes low, with a more competitive and efficient tax system, we will support Australia’s future economic growth.

We are delivering on this commitment through the legislated Personal Income Tax Plan which is creating a more competitive and efficient tax system.

It is a plan that will ensure around 95 per cent of taxpayers face a marginal tax rate of no more than 30 per cent when the final stage is implemented.

Our track record shows that Australians can rely on this Government to continue delivering tax relief as fiscal capacity permits.

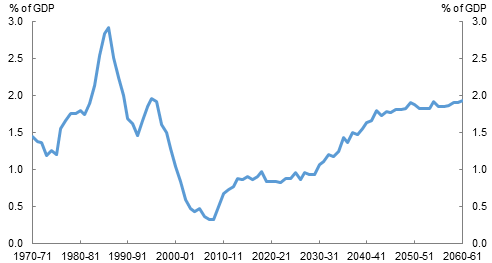

In the IGR we make the prudent assumption that the cost of borrowing will rise over time.

Notwithstanding this assumption, interest payments remain relatively low as a share of the economy.

In 2060‑61, interest payments are projected to be around 2 per cent of GDP.

In the mid‑1980s, interest payments on Australian Government debt were close to 3 per cent of GDP.

The IGR projects net debt will peak at 40.9 per cent of GDP in 2024‑25, before falling to 28.2 per cent of GDP in 2044‑45 and then gradually increase to 34.4 per cent of GDP by 2060‑61.

So, even assuming there is no policy change, the IGR projects that debt as a share of the economy remains relatively stable over the long term.

This is a fiscally sustainable position, in which the government’s obligations are growing no faster than its capacity to raise revenue.

Interest payments on government debt

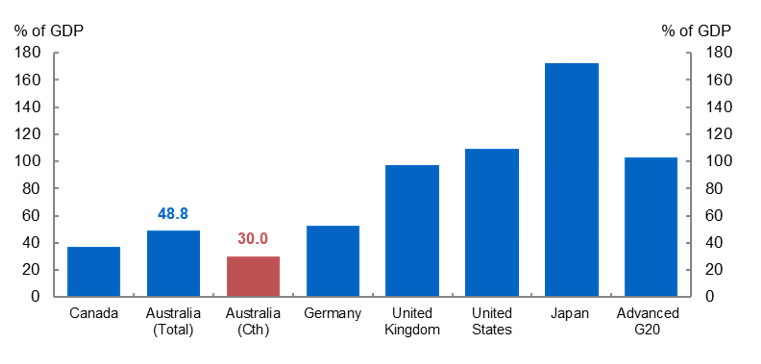

Australia’s levels of debt are low by international standards.

As a share of the economy, Australia’s net debt today is around half of that in the UK and US and less than a third of that in Japan.

International comparisons of net debt, 2021

With a lower debt burden than a majority of comparable countries, we have a more sustainable position with lower debt servicing costs and risks.

While our debt remains very manageable, our fiscal strategy will focus on reducing debt as a share of the economy once the unemployment rate is sustained below pre‑COVID levels.

This will help prepare us for known pressures as well as unexpected risks in the future.

The way forward

This year’s IGR is an important and timely document.

It details the economic challenges, and the opportunities facing Australia.

It underlines the fact that the economic impact of COVID‑19 is not short lived

COVID‑19 will see our population smaller and older and our debt levels higher.

In the absence of our COVID economic response Australia could have seen a generation of long term unemployed leading to a significant scarring effect and serious damage to the budget.

While the IGR confirms Australia’s debt positon remains sustainable fiscal discipline remains key.

Growing the economy is Australia’s pathway to budget repair not austerity or higher taxes.

This is why we remain committed to our tax to GDP cap, ensuring our COVID economic support is temporary and pursing productivity enhancing structural reforms.

Ladies and gentleman, as fate would have it, when I was discussing last month the IGR projections with Treasury I received a call from Peter Costello.

He reminded me that IGRs always deliver sobering news.

This IGR is no exception.

While Australia is relatively well placed, there are at the same time, some warning signs.

And it is up to governments to respond.

We are.

We will.

There remains much work to be done.