Hello and welcome to my Newsletter on the Rudd Government's ongoing fight against tax crime.

The news continues to get better in this important area — with our investment in tracking down tax cheats returning greater dividends by the day.

An all too common method of tax avoidance or evasion for would‑be cheats is the use of tax havens.

While there's nothing wrong with earning income from offshore activities, not paying tax on it cheats all Australians who do the right thing.

The abuse of tax havens is a significant risk to the integrity of Australia's tax system.

In the past two financial years, a total of more than $30 billion was sent directly from Australia to offshore financial centres and $54 billion was sent from these jurisdictions to Australia.

The problem is large scale and insidious — but we are making headway.

Project Wickenby — recent developments

Project Wickenby is a massive investment in the integrity and fairness of our tax system and has already raised over half a billion dollars in tax liabilities and more than $465 million in cash collections.

In its last Budget, the Rudd Government provided $122 million extra funding for Project Wickenby investigations over the next three years.

The Chief Executive Officers of the various Project Wickenby agencies provided a recent update on the progress of this taskforce charged with cracking down on tax haven abuse.

Wickenby agencies are the Australian Crime Commission, the Australian Taxation Office, the Australian Securities and Investments Commission, the Australian Federal Police, Commonwealth Director of Public Prosecutions, AUSTRAC, and the Attorney‑General's Department.

I would like to provide more information on the impact the project is having.

The current balance sheet as at 31 December 2009

Compliance Dividend: The most pleasing result of the success of Wickenby has been its deterrent effect. Tax collections in subsequent years from people subject to Wickenby action (compliance dividend) now totals $299.33m.

Tax Collections: $160.08m, including from audits and from tax returns demanded by the ATO. Other moneys recouped total $5.92m.

These dividends make for a Total Cash Collection of $465.33m.

This $465.33m additional tax revenue is well ahead of the Wickenby commitment to provide Government $408 million by 30 June 2010.

Wickenby participants are paying more

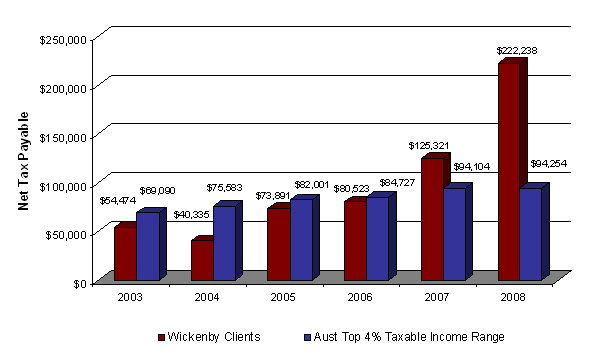

People involved in Wickenby, including high income earners, are now paying more tax.

The average net tax paid by Wickenby participants increased by 276 per cent in five years, from $54,474 in 2003 to $222,238 in 2008.

These people have either voluntarily lodged tax returns that more accurately declare their taxable income or have lodged returns where they may have previously not done so — as well as paying back tax.

The average net tax payable by associates of these taxpayers has also increased by 153 per cent.

Over the same period, the average net tax payable for the top four per cent of taxpayers (a "control population") increased by only 30 per cent.

Tax liabilities

As of 31 December 2009, Wickenby had also raised $532.79m in tax liabilities — that's what people who have been audited or reviewed as part of Project Wickenby have been assessed as owing the Australian community.

There in an interesting point relating to these audits — they are not random selections of suspected tax avoiders, but audits and reviews based on excellent information including intelligence from overseas and promoter information.

Of 1078 completed audits and reviews, 1092 assessment notices were issued. In other words, there is a very high success rate with the majority of audits providing a return for the Australian community.

The international money flow

The Rudd Government strongly supports the Tax Office's continued efforts to detect and deal with those who use offshore transactions to conceal assets and income.

The latest figures on the international flow of funds suggest Wickenby is having a deterrent effect.

Declines in international funds flow

International transfers to Vanuatu, Switzerland and Liechtenstein have declined in the order of 25‑35 per cent.

While some decline in international funds flow could relate to the global economic downturn, the bigger decline in the value of transfers to these regions reflects a likely deterrent impact from Wickenby.

Supporting the new offshore voluntary disclosure initiative

The new voluntary disclosure arrangements are an opportunity for people to act now to disclose any offshore income they may not have previously declared.

Here again, the message is getting through — "It is much harder to hide."

The project, to December 2009, has identified omitted income of $354.9 million and raised $69 million in liabilities from over 3,500 disclosures.

Australia's leadership role

Australia is playing a leading role in international efforts to have all jurisdictions committed to rigorous transparency and exchange of information standards.

Australia's election to the role of chair of the significantly reformed and boosted Global Forum on Tax Transparency illustrates exactly how seriously the Rudd Government is taking its leadership role in shifting international attitudes.

The Government has launched negotiations around the world and, so far, 11 jurisdictions previously identified by the OECD as not committed to the internationally agreed tax standard have signed tax information exchange agreements with Australia.

The OECD estimates up to $7 trillion dollars in global assets are held 'offshore' in tax havens, threatening government revenues and the integrity of the international financial system.

Australia, as Global Forum chair, will push hard to see the new agreed tax transparency peer review system put rapidly in place.

The Rudd Government is committed to safeguarding the tax system for the benefit of all Australians and is determined to crack down on cheats.

I hope to bring more good news in the fight against tax crime next time.

Bye for now.

Nick Sherry

Assistant Treasurer