The Government is rebalancing the suite of policies supporting private health insurance – so that those with a greater capacity to pay for their own private health insurance do so.

Consistent with the Government’s commitment to maintaining the balance between public and private health systems, high income earners will receive less Government payments for their private health insurance, but will face an increase in costs should they opt-out of their health cover.

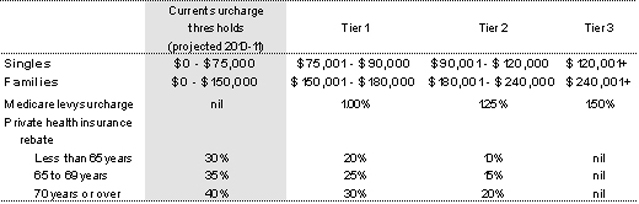

From 1 July 2010, the Government will introduce three new ‘Private Health Insurance Incentive Tiers’ – so that higher income earners receive less ‘carrot’ and more ‘stick’ to be insured:

- Tier 1: for singles earning more than $75,000 (couples $150,000), the Private Health Insurance Rebate will be 20 per cent for those up to 65 years (25 per cent for those over 65, and 30 per cent for those over 70 years). The Surcharge for avoiding private health insurance will remain at one per cent.

- Tier 2: for singles earning more than $90,000 (couples $180,000), the Private Health Insurance Rebate will be 10 per cent, for those up to 65 years (15 per cent for those over 65, and 20 per cent for those over 70 years). The Surcharge for avoiding private health insurance will be increased to 1.25 per cent.

- Tier 3: for singles earning more than $120,000 (couples $240,000), no Private Health Insurance Rebate will be provided. The Surcharge for avoiding private health insurance will be increased to 1.5 per cent.

All income thresholds would continue to remain indexed to wages, keeping these changes fair and sustainable into the future.

These changes will affect around 10 per cent of Australian adults.

For low and middle-income earners, the existing 30, 35 and 40 per cent Private Health Insurance rebates will remain in place.

These reforms will provide a fairer distribution of benefits, bringing Government support for private health insurance in line with the principle underpinning the Australian tax-transfer system – that the largest benefits are provided to those on lower incomes.

By 2010-11, it is expected that approximately 14 per cent of single tax filers with incomes above $75,000 will receive about 28 per cent of the total Private Health Insurance Rebate paid to singles. Under the new reforms, these single tax filers will receive about 12 per cent of the total Private Health Insurance Rebate paid to singles.

Similarly approximately 12 per cent of couple tax filers who have incomes above $150,000 will receive around 21 per cent of the total Private Health Insurance Rebate paid to couples. Under the new reforms, these couple tax filers will receive about 9 per cent of the total Private Health Insurance Rebate paid to members of couples.

Treasury modelling estimates that under these reforms, 99.7 per cent of people will remain in private health insurance. This is because those high income earners who receive a lower rebate will face a higher tax penalty for avoiding private health insurance.

Spending on the current Private Health Insurance Rebate is growing quickly and expected to double as a proportion of health expenditure by 2046-47.

These changes will result in a saving to Government expenditure of $1.9 billion over four years.

These reforms will ensure that Government support for private health insurance remains fair and sustainable in the future.

Table 1: New Private Health Insurance Incentive Tiers