The Treasurer, Wayne Swan MP and the Minister for Financial Services, Superannuation and Corporate Law, Chris Bowen MP, today announce changes to the supervision of Australia's financial markets that will enhance the integrity of Australia's financial markets and take another step towards establishing Australia as a financial services hub in the region.

The Government has decided to provide for the Australian Securities and Investments Commission (ASIC) to perform supervision of real-time trading on all of Australia's domestic licensed markets. This change will mean that ASIC will now be responsible for both supervision and enforcement of the laws against misconduct on Australia's financial markets.

'Australia's financial system has performed better than any other during the global recession and these reforms will ensure that Australia's regulatory arrangements remain among the best in the world,' Mr Swan said.

'As part of the Government's drive to improve regulation of the financial industry, the Government has decided to transfer supervisory responsibility for Australia's financial markets to ASIC as it is more appropriate for an agency of the Government to perform this important function,' Mr Bowen said.

The present arrangements require individual financial markets to self-supervise trading on their individual markets.

This reform is in line with the move towards centralised or independent regulation in other leading jurisdictions.

'Having one whole-of-market supervisor will consolidate the current individual supervisory responsibilities into one entity, streamlining supervision and enforcement, and providing complete supervision of trading on the market,' Mr Bowen said.

'Moving to whole-of-market supervision is also the first step in the process towards considering competition between market operators.'

The changes will mean that ASIC will become responsible for supervising trading activities by broker participants which take place on a licensed financial market, while individual markets – such as the Australian Securities Exchange (ASX) - will retain responsibility for supervising the entities listed on them.

'The supervision of listed entities raises a different set of issues. The Government is comfortable that there is no need for the Government to supervise listed entities. ASIC and the ASX are working well together in performing this role,' Mr Bowen said.

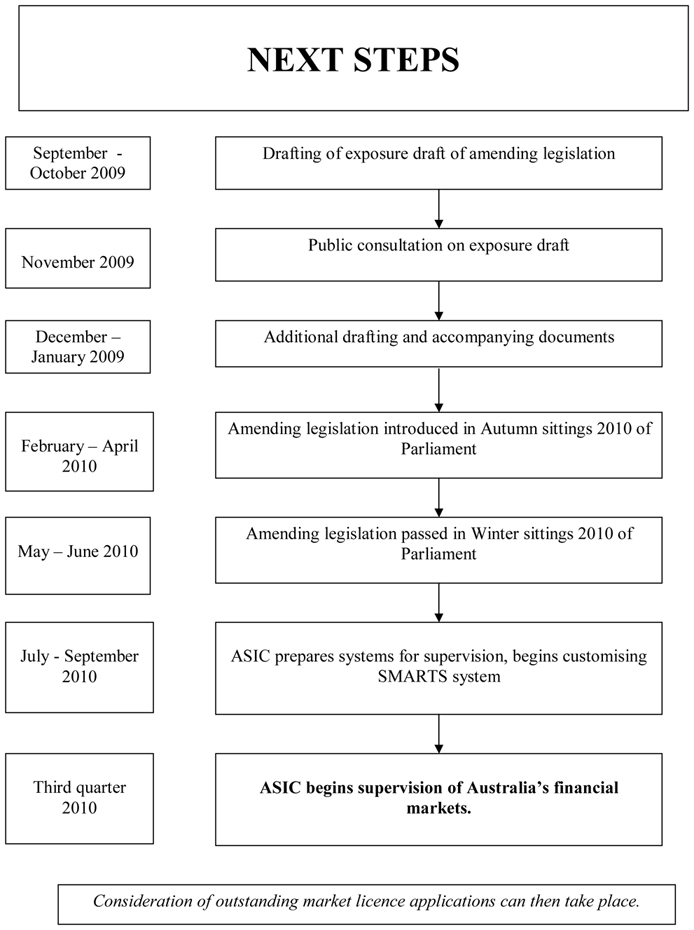

It is intended that legislation will be introduced into Parliament next year to give effect to this change, with ASIC to begin performing these functions in the third quarter of 2010.

Attachment

Supervision of Australia's Financial Markets

There is a considerable amount of transitional work to be done in preparation for this transfer. Legislation must be drafted, consulted on and then taken through both houses of parliament.

ASIC has advised the Government that they may need 3 months after the passing of the Act to ensure they are appropriately prepared. Once all necessary steps have been taken, and ASIC advises the Government it is ready to proceed, the transfer will take effect.

The handover is expected to be completed by the third quarter of 2010.