Thanks very much for having me here today.

It's been a tough couple of weeks as you can imagine, on top of a tough couple of months before that. But this is the best part. This is the part where I can get out on the road and talk to businesses across the country about what this Budget actually means.

This Budget is about responsibility. It's about strengthening the Australian economy. It's about helping families. And it's about securing future growth.

And we've done all this by delivering on the strict fiscal strategy we set ourselves - getting us back to the black in three years, and three years early.

I strongly believe that this Budget sets a new benchmark for responsible economic management - and of course it's the envy of the developed world.

While Australia's recovery is going to plan, the current situation in Greece reminds us that there remain enduring downside risks in the global economy.

Of course our Budget had to be framed against this uncertain backdrop - which only reinforced the importance of consolidating our own balance sheet. But at the same time, we knew we had to keep the ball rolling on the serious reforms Australia needs to stay internationally competitive into the future.

And it's this reform agenda I want to talk about today. But I'll start by just giving you a sense of the challenges we're still seeing in the global economy.

Two-Speed Recovery

Many of you will be aware that the global recovery is still fragile. The volatility in capital markets across the world is a symptom of this underlying fact.

We've got different parts of the world growing at two very different speeds. Sitting on the edge of Asia as we are, we're in the fast lane and shifting into third gear - while many major advanced economies are still stuck in first.

Of course nobody in this room needs to be reminded of the bleak outlook for your own businesses last year, when the global economy fell off a cliff.

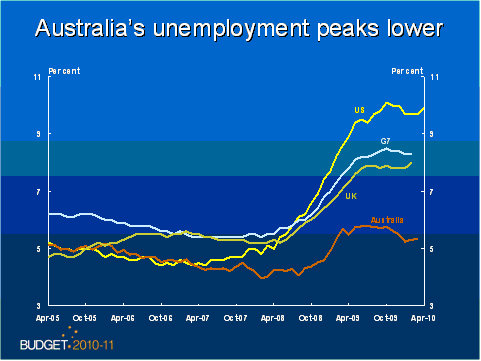

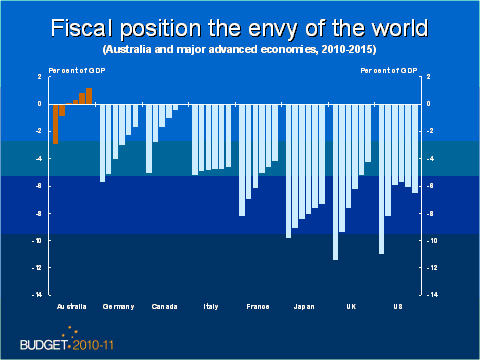

And the major advanced economies are still faced with a long slow grind towards recovery some years away - with near double-digit unemployment and a big deleveraging task still ahead. I think this chart really highlights just how uneven the global recovery still is.

The reality of the situation they face over there is only now setting in - it's taken the latest round of events in Greece to focus them on the magnitude of their challenges. Diplomatic protocols prevent me from running you through some of the conversations I had with my G20 counterparts last month - but I can say they were very sobering indeed.

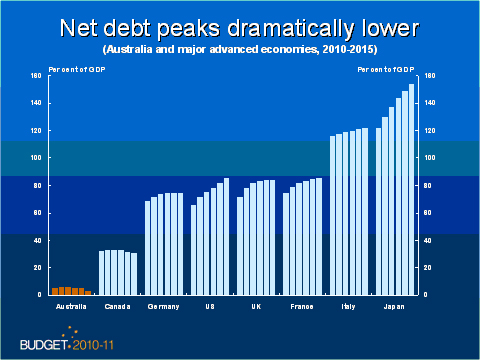

The turbulence on global financial markets over the last few weeks reminds us just how critical one commodity is in fiscal terms - credibility. I think the next chart shows pretty starkly how well we're placed on this score.

I can tell you that from where I stood in late 2008, it looked like all developed economies would suffer the same fate, with none to be spared the destruction of skills and capital that were sure to follow deep global recession.

But by pulling together - business, workers and government - we avoided recession when most others didn't. I want to thank you for your role in that.

And now our economy is forecast to rebound strongly with real GDP growth of 3¼ per cent in 2010-11 and 4 per cent in 2011-12 - it's a remarkable story.

But of course we need to be mindful that our own recovery is running at two speeds just like the global recovery. Not across states, but across sectors.

The return of boom conditions in mining will make things much tougher for industries like financial services, manufacturing, construction and tourism. These industries find it much harder to find workers and capital, and the stronger dollar makes them less competitive in their own global markets.

So the question is how do we broaden our economic base? How do we ensure that we keep growing sustainably across the country and across sectors?

In a two-speed economy like ours, it's the Government's responsibility to do all we can to grow our other sectors without holding the mining industry back. That's why our tax reforms will prepare us for Commodity Boom Mark II.

Broadening Our Economic Base

The principle underlying all of this is that all Australians - all industries, all businesses - should get a fair return from our non-renewable resources. It's only by getting this return that we're able to make the changes we need to build a stronger, broader economy while keeping resource charges efficient.

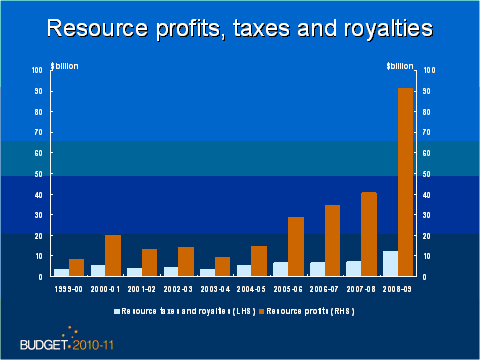

Before the last mining boom, Australians got $1 in every $3 of mining profits through royalties and resource charges but by the end of that boom, that was down to just 1 in 7. The idea is simple - it's just taking the Australian people's share of mining profits closer to where it was in the early 2000s, before the long slide. I think this next chart shows just how long that slide has been.

If the taxpayer's share of resource rents had remained constant over the past decade or so, Australian governments would have collected $35 billion in additional revenue.

But it's about more than this. It's about making sure royalty regimes don't discourage investment. The Resource Super Profits Tax will encourage it.

We'll overhaul the old inefficient royalties regime and put a modern system in place to improve the viability of mining investments, particularly more marginal and risky start-up projects.

And critically, around one-third of the proceeds from the RSPT will be directed to supporting broad-based economic growth by cutting business tax. We've announced we'll reduce the company rate to 29 per cent in 2013-14 and then cut it further to 28 per cent from the 2014-15 income year. This reform is critical to improve our global competitiveness across all industries, create new jobs and grow the economy right around the country.

And nowhere is this more important than for small businesses - which make such a massive contribution to growth and to keeping Australians in jobs. That's why we're giving small businesses a head start on the company tax rate cut - so they can get ahead of the curve and get behind the recovery.

And we're also providing further tax relief to small business through a $5,000 instant write-off of assets - reducing compliance costs and saving them time. This allowance will immediately increase small businesses' cash flows enabling them to pay their creditors on time and reinvest for future growth.

Building Productive Capacity

While we're positioning Australia for broad-based economic growth, we're focused on ensuring we can do this with sustainable low inflation into the future through lasting improvements to our economy. That's why our focus in the Budget was on building capacity in the post-crisis economy.

Although the Australian economy is still operating a little below capacity today, we're preparing for the day when it approaches capacity again. And because we outperformed all expectations, we'll deal with re-emerging capacity constrains sooner than other nations with weaker economies.

That's why the Budget continues our strong commitment to building the infrastructure and skills bases we need to maximise our future prosperity.

We're ensuring infrastructure is a permanent feature of both state and federal budgets so we can keep working towards filling the infrastructure deficit that was left to widen over the last decade or so.

The centrepiece of this commitment is an infrastructure fund worth some $5.6 billion over the next ten years, flowing straight from proceeds of the RSPT. Of course, this fund will recognise the large infrastructure needs of the resources states - representing a direct reinvestment into building economic capacity so that our resources sector can continue to grow sustainably.

And we're investing nearly $1 billion of additional equity funding into ARTC to implement a productivity enhancing package of rail freight projects.

But it's important not to overlook some other critical investments included in the Budget, like some $70 million to progress the development of an intermodal terminal precinct at Moorebank here in Sydney. The terminal will address the critical shortage of intermodal capacity in Sydney and compliment our substantial investments in rail. It will provide a much needed integrated transport solution for the movement of freight to and within the Sydney basin which will boost national productivity, reduce business costs, and relieve bottlenecks and urban congestion.

But it's not just infrastructure which is central to expanding our capacity. It wasn't very long ago that the Australian economy was facing skills shortages that were constraining growth and contributing to wage and price pressures.

That's why in the Budget I announced a new $660 million Skills for Sustainable Growth strategy - to immediately help build critical capacity. It's a cohesive strategy to boost our skills base and ensure our education and training systems are flexible and responsive to our future skills needs.

Saving For Our Future

But as well as skilling for the future, we also need to save for the future.

The 2010 Intergenerational Report, which I released in February, really highlighted the challenges Australia faces from an ageing population.

The Government is focused on growing our retirement savings pool to alleviate longer-term fiscal pressures and help to finance a growing economy.

It's simply amazing to think that by 2050, the number of Australians aged 65 and over is projected to grow from 3 million to a staggering 8.1 million.

Of course, in last year's Budget we took significant steps to increase aged pension payments and place the pension system on a sustainable footing.

And now in our third Budget, we have gone even further to shore up the long-term adequacy of our nation's retirement income by announcing an increase in the Superannuation Guarantee to 12 per cent over the coming years.

But we'll also improve equity for low income earners, by in effect refunding contributions taxes for those on marginal tax rates 15 per cent or below. This will reverse the current situation where they receive little or no concession on their contributions, which are taxed at 15 per cent. It just simply doesn't make sense to have a situation where some low income earners pay more tax on their super contributions than their labour income.

And we're helping over-50s top up their super balances when they're most able to afford it - by keeping their $50,000 concessional contributions cap.

Plus our new 50 per cent discount for interest income up to $1,000 is moving us towards a more consistent savings taxation regime, benefiting some 5.7 million depositors across Australia.

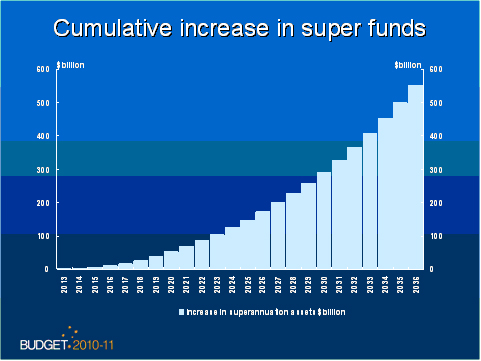

So what does all this really mean? Well, it means growing our pool of national savings, it means financing an investment in our future, and it means providing for our ageing population.

I think this next chart shows that really well. It gives you an idea of the magnitude of the changes we're making. You can see that by 2036, our superannuation reforms will have added around another $550 billion to superannuation savings.

Or put simply, it means securing benefits that last.

But it's only because of our shared successes during the crisis, and because of our tax reform agenda to share the wealth from our non-renewable resources, that we'll be in this position at all to build this sustainable future.

Australia as a Financial Centre

But I just want to talk briefly about our plans to build Australia's reputation as a regional hub for financial services in Asia.

As a centre of finance in Australia, Sydney stands to gain immeasurably from an increasing global recognition of our sophistication and robust supervision.

As part of the Budget last week, we responded to the Johnson Report, which we commissioned from the Australian Financial Centre Forum in 2008.

You'll be aware that the first thing we're doing is phasing down the interest withholding tax paid by financial institutions on borrowings from a related company overseas. This was a key recommendation of both the Johnson Report and the independent tax review. It will remove the tax distortions smaller foreign lenders face, giving them access to cheaper funding so they can compete.

And then we've offered a new tax incentive that cuts the tax paid on interest income from a range of savings products for the first $1,000. This will promote deposits as a tax-effective savings vehicle and help to reduce the average cost of funding for our financial institutions. All banks, building societies and credit unions - especially the smaller ones -are expected to benefit from a greater supply of stable deposit funding, reducing their need to borrow in volatile international capital markets.

And it's critical also that the tax discount applies to interest income on corporate bonds, in the same way that it applies to debentures and annuities. This represents a really important step in helping to develop a deep and liquid Australian corporate bond market, making it easier for Australian businesses to diversify their funding sources as an alternative to borrowing from the bank.

And this measure also compliments ASIC's reform to allow listed companies to issue bonds to retail investors using a simplified disclosure process. When you throw in a lower corporate tax rate, it all starts to look pretty good.

Back in the Black Three Years Early

Of everything we've achieved, I'm proudest of the fact that we've been able to make all the investments I've just mentioned, and quite a few more, while still returning to surplus in three years, three years ahead of schedule.

Of course this itself was only possible because of timely and decisive fiscal stimulus which supported our economy during the worst of the financial crisis. None of this would be even realistic without the success of stimulus - without employers, employees and government joining to beat the global recession.

We kept the economy growing. Which means we're now building from a position of strength - we're not wading through the rubble of recession.

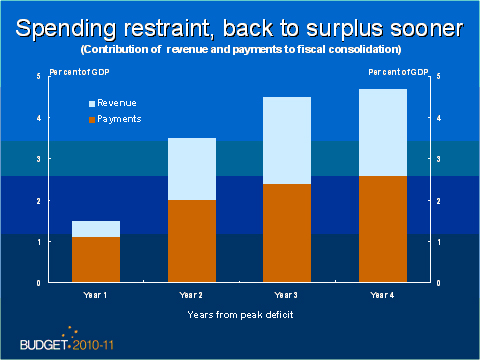

And now we've delivered a disciplined Budget in which we've stuck to very strict limits on spending while also responsibly investing in Australia's future. With the economy to grow back above trend in 2010-11, we've delivered on the commitment we imposed on ourselves to restrain growth in real spending to 2 per cent. And we've offset every single dollar of new expenditure since MYEFO, through additional savings - just as we said we would.

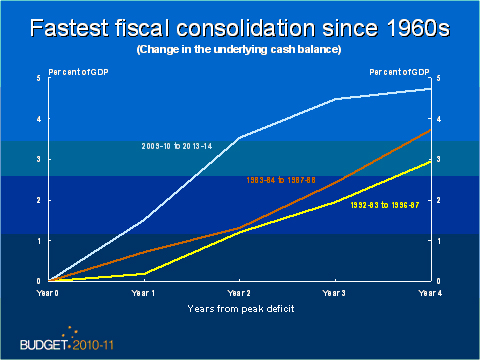

In fact this Budget delivers the fastest fiscal consolidation since at least the 1960s - much more rapid than after the recessions of the 1980s and 1990s.

And critically, of the 4½ per cent of GDP turnaround in the budget position out to 2012-13, spending restraint accounts for more than half.

All this involved substantial rebalancing, to allow meaningful progress on the big-ticket reforms, while putting the Budget on a sustainable footing. But it means every dollar of stronger revenue will flow through to the budget bottom line. We have banked all of the benefits from the stronger economy.

The Budget has responsible economic management firmly at its core - and puts us on track to be back to surplus ahead of the major advanced economies.

Making the Most of Our Opportunities

But I just want to sum up by talking briefly about where we've come from over the last three years, and the opportunities which now lie ahead of us.

As the global economy slowly climbs out of recession and gravitates towards Asia, we can expect that Australia will become one of the biggest winners, if not the biggest.

This makes me an optimist about the future of our economy as I expect some of you in this room are as well - as too is the Governor of the Reserve Bank. Governor Stevens said recently that: "We are located in the part of the world that is seeing the most growth. And in terms of fiscal sustainability, Australia's position is, by any measure, very strong indeed."

Clearly the success of our stimulus and our geographic advantages give us cause for confidence - but we can't afford to be complacent. We have to work together to get the settings right and make the most of our unique position on Asia's doorstep - and translate it into balanced growth.

And when the Australian people decide this year who's qualified to lead this transition, they'll see the Rudd Government already has runs on the board. We kept the economy growing through the global recession, leaving us with a rock-solid balance sheet to meet the national challenges ahead.

Now we're already doing the hard yards on the tough reforms like tax and health, while we still invest in our capacity through skills and infrastructure. And we'll continue to build from this position of strength, to break from the pack and make the most of the future. Thanks for having me.